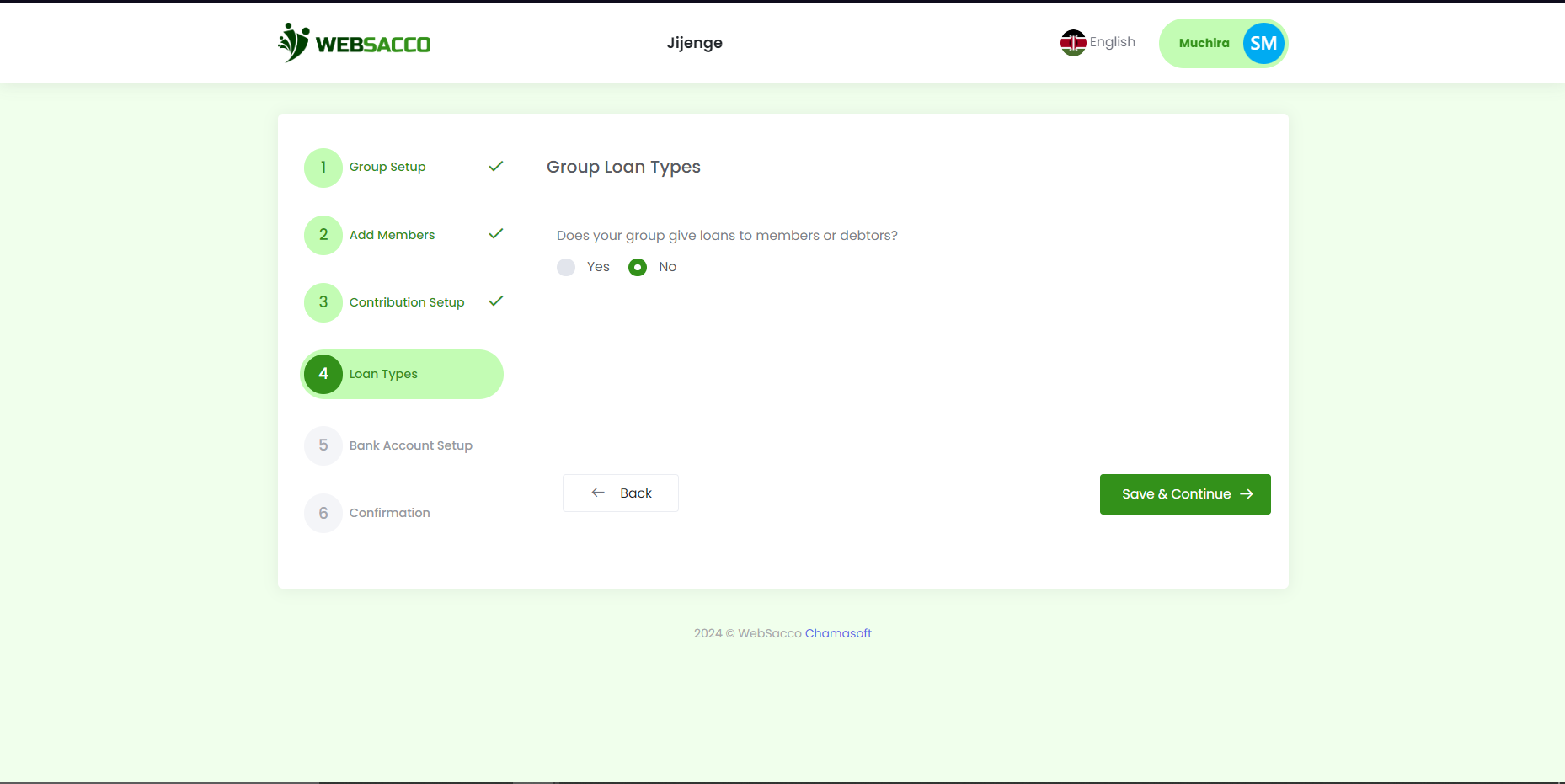

Websacco gives your investment club a venue to give loans, apply for loans, and monitor them. To start giving members loans, you must create loan type(s) for your group. Follow figure below for detailed information on how to create group loans, and fines for these loans based on a fixed amount or a percentage.

NOTE: After confirming your group offers loans to the members you will be redirected to the page where you can set up the loan types. Shown in the tables below.

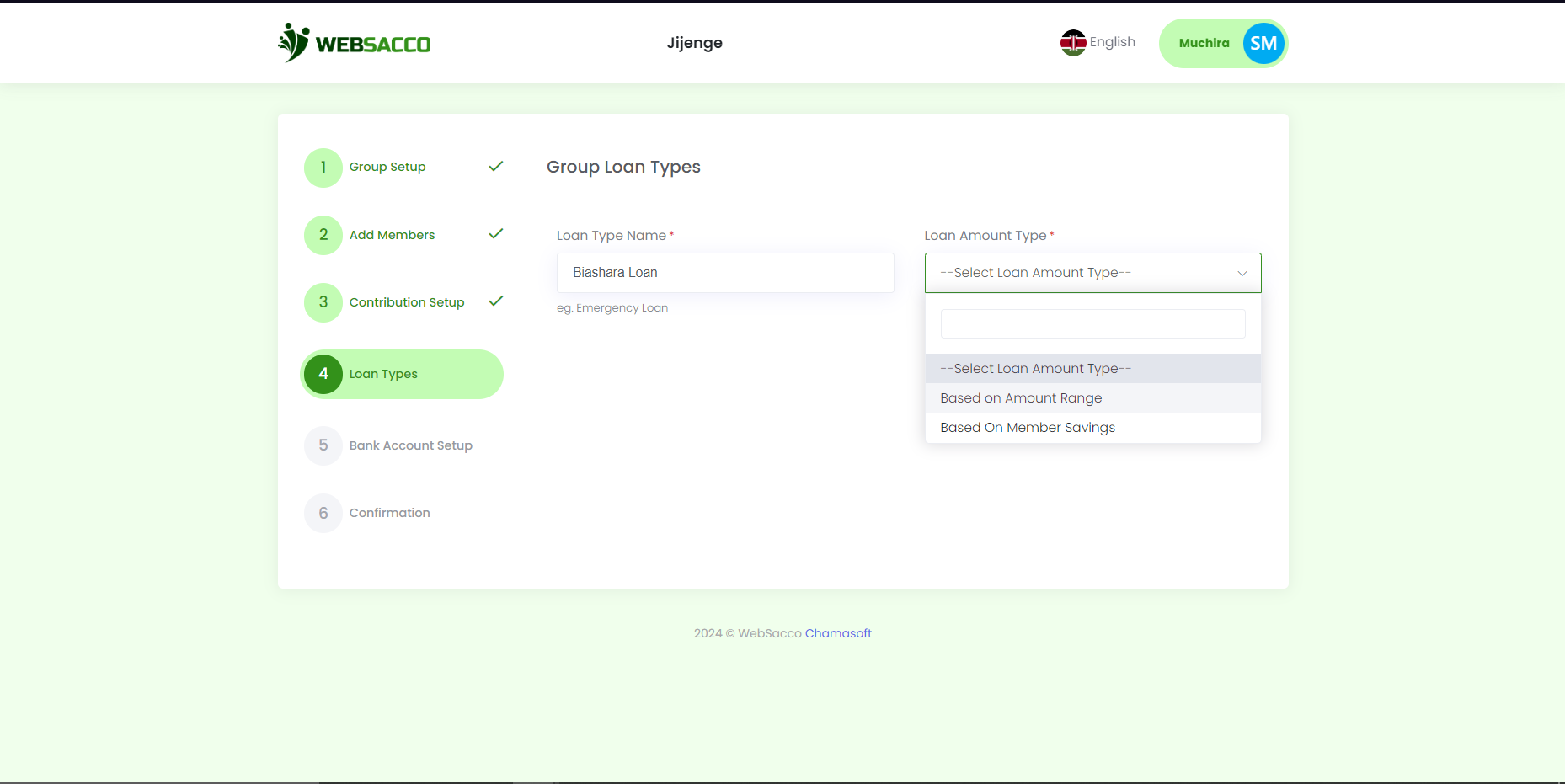

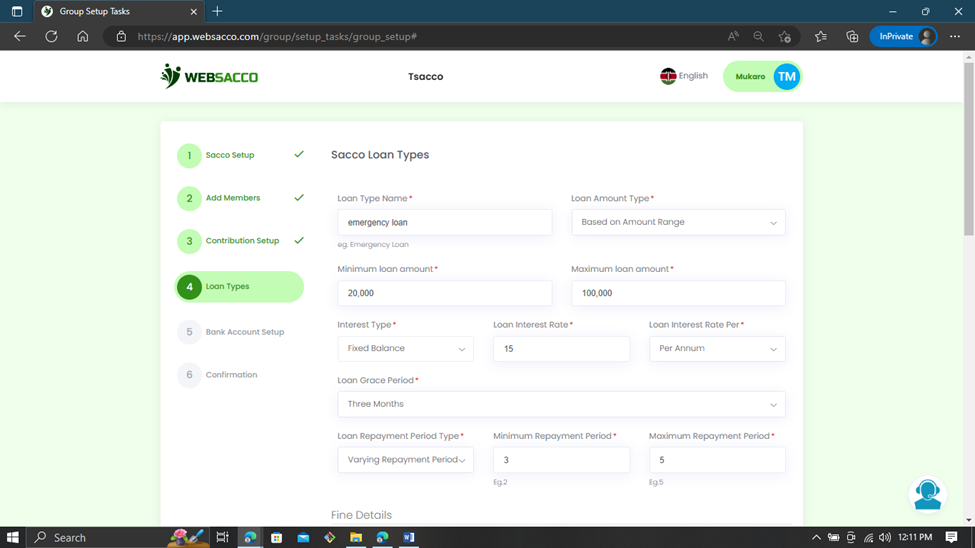

An example of creating a custom loan type:

Interest can also be set up by choosing the various options supported:

| Indicators | Definition |

| Loan Type Name | This is where the administrator will select the type of loan the group offers its members. E.g. (Emergency loan) |

| Loan Amount Type | This is where the administrator will select the loan amount based on. (amount range, member savings) ➢ If you select depending on member savings, then input the number of times the loan is based on per member savings. ➢ If you choose a fixed amount, then proceed to value 3. |

| Minimum Loan Amount | This is where you will capture the minimum amount a member can apply. |

| Maximum Loan Amount | This is where you choose the maximum amount the member can apply. |

| Loan Interest Rate per | This is where you can select the type of interest charged on the loan. whether it is based on a fixed amount or a reducing balance. |

| Loan Grace Period | This is where the administrator will select the grace period offered to members to repay the loan. |

| Maximum Repayment | This is where the administrator will select the loan repayment period, whether fixed or reducing balance. ➢ If you select a varying period, then input the minimum and maximum repayment period. ➢ If you select a fixed period, then proceed to value the fixed amount of time, which members are required to make repayments. |

| Indicator | Definition |

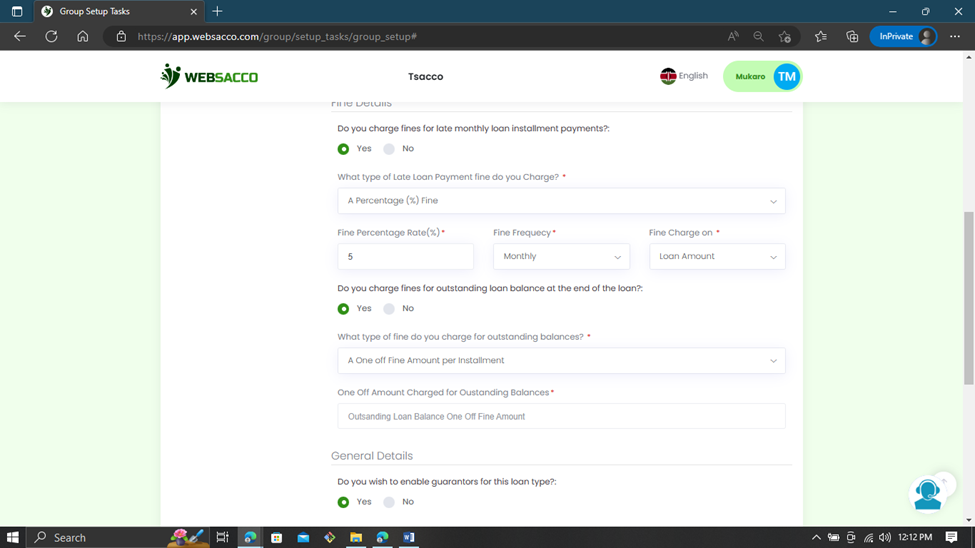

| Option 1 | This is where you choose whether to enable fines for late loan payments. |

| Loan Payment | This is where you choose the type of fine charged. (One off, fixed, or a percentage) ➢ For a one off fine ○ Select the one off fixed amount or percentage ○ Select the fixed amount or the percentage and amount it is based on. ➢ For a fixed fine ○ Select the amount of money charged for the fine ○ Select the frequency of the fine charged. ○ Select what the frequency is based on. (e.g. total outstanding balance.) ➢ For a percentage fine ○ Select the fine percentage charged. ○ Select the frequency of the fine ○ Select the amount in which the fine frequency is based on. (e.g. total outstanding balance) |

| Fine Charge | For a percentage fine ○ Select the percentage rate charged for the fine ○ Select the frequency of the fine charged. ○ Select what the frequency is based on.(e.g. total outstanding balance.) |

| Option 2 | This is where you can select if you charge fines for outstanding loan balance at the end of the loan. ➢ For a one off per installment fine ○ Select the one off per installment amount or percentage. ➢ For a fixed fine ○ Select the amount of money charged for the fine ○ Select the frequency of the fine charged. ○ Select what the frequency is based on. (e.g. total outstanding balance.) ➢ For a percentage fine ○ Select the fine percentage charged. ○ Select the frequency of the fine |

| Outstanding Balance | This is where the administrator sets the one off charges fine. |

| Charges on Outstanding Balance | This is where the administrator sets the one off charges amount |

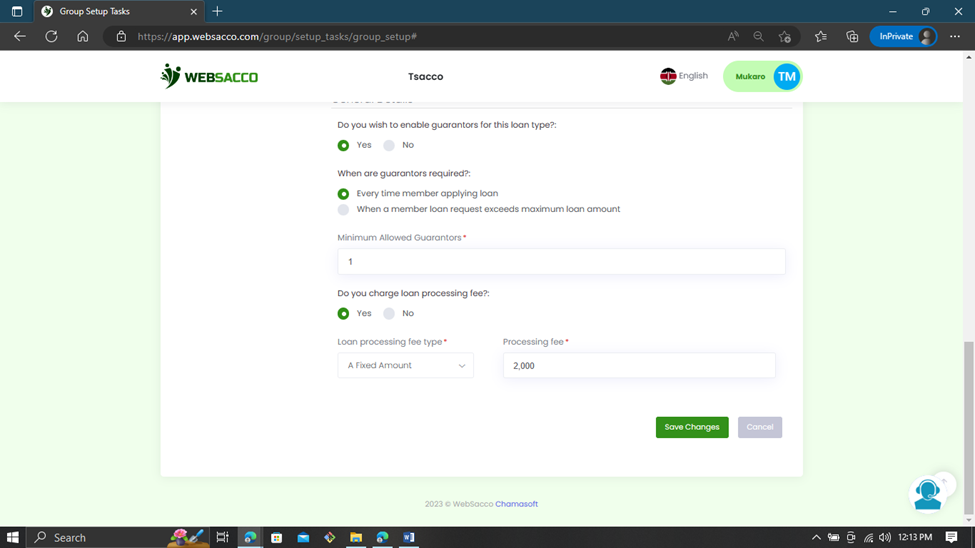

| Option 3 | This is where you enable or disable guarantors for this type of loan. |

| Indicator | Definition |

| Guarantors | Once guarantors are enabled one has these two options: ➢ Every time a member applies for a loan. ○ Select the minimum number of guarantors required for this type of loan. ➢ When a member loan request exceeds maximum loan amount. ○ Select the minimum number of guarantors required for this type of loan. |

| Minimum Allowed Guarantors | This is where the administrators sets the minimum guarantors needed |

| Loan Processing Fee | This is where the administrator adds a loan processing fee for members. |

| Processing fee Amount | ➢ For a percentage loan processing fee ○ Select the percentage charged. ○ Select the amount in which the percentage loan is based on. (e.g. total amount of loan.) ➢ For a fixed loan processing fee ○ Select the amount of money charged for the loan processing fee |

| Save Changes | Save and continue ○ This saves your progress and redirects you to the next stage. |

Next Step is group account